I got my break today from the on-going

due diligence review so I got this chance to post. (Wait a minute, I'm doing this in my office! I'm so

happy!)

The highlight of this week, aside from the

State-of-the-Nation Address (SONA), was probably MER (on a speculation of a

tender offer) hitting a high of 302.50 on Wednesday, gapping down and went to a low of 190 the next day, reaching a high of 267.50 on Friday, before closing at 229! I'm really awestruck at this volatility. This explains the volatility of PSEi this week. I knew that MER would "crash" on Thursday after seeing huge crosses at 300 the day before that, as I knew that the buyer was already satisfied (at least partially). Initially I thought MER will drag down the market, but I was pleased to see that the funds liquidated from MER were moved to other sectors particularly properties and banking. This was a good sign of healthy fund movement. We even experience huge net foreign buying yesterday!

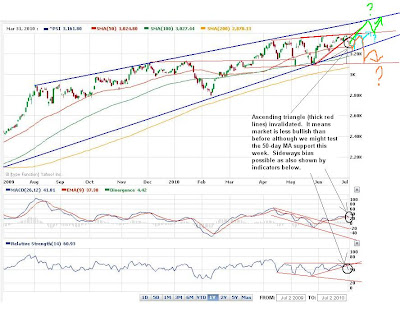

Technical analysis of PSEi (clickable):

It seems that PSEi broke out of 2,790 and is now moving towards the next resistance at 2,880 (dotted line). It will be harder for PSEi to move up for now as the indicators are pointing to overbought levels. 2,626 remains its support. Actually it's hard for technicians like me to judge the top of the market as much of the volatility lately was skewed by MER. Reverse head and shoulders formation (bullish) is still intact.

---------------

Trades:

Remember the holding company that I said I'm looking intently? It was

Ayala Corp. (AC). It is forming a reverse head and shoulders pattern beautifully with neckline at 320. I got a significant portion at 300. Should the neckline be broken convincingly, we should see target 450 to 460. :)

AC weekly:

I also bought back PAX at 2.8. 3 to 3.1 has proved to be a stubborn resistance. Thus I sold all of this at 2.85 average.

I was lured back to LC again at 0.28 due to strong volume on Monday. Well, I anticipated that this would breakout 0.28 that day too, but it didn't. I guess everyone's focus was on MER this week. I decided to cut this one at 2 fluctuations lower. Chartwise, I wasn't that bullish anymore. Negative divergences with MACD and RSI were forming. 0.25 is a very critical support.

I bought a little

Minerales Industrias Corporation (MIC) as well only to cut it on the very same day. :( I was whipsawed, thinking that it broke out of 3.5. I decided to transfer my proceeds to MER and FLI. I ordered to purchase a minuscule of MER at 262.5, but only half was matched. :( I took this gamble to purchase MER because momentum was there. I threw out my technical analysis for I know it won't work on this stock. I sold MER too early the next day at 282.5 (that day hit a high of 302.5).

I got a good chunk of

Filinvest Land Inc. (FLI) at 0.92 (a bit too high though), because it broke out of 0.87 resistance quite convincingly (with big volume). Property is in play right now, and I believe will spill over to next week together with banks.

I cut all my TUNA at one fluctuation lower than my cost because it was too slow (read: impatience).

I'm happy to hitch a ride with

Cyber Bay Corp. (CYBR) at 0.75 average on

rumors that a third party investor wants to buy into the company. Also, I bought a minuscule

Sinophil Corp. (SINO) at 0.27 on recurring exceptional volumes and breakout.

Composition:AC = 24%

GMA7 = 19%

FLI = 16%

WEB = 11%

CYBR = 10%

SINO = 7%

Odd-lots = 2%

*Oops! Broke cardinal rule again. :(

Portfolio invested: 89%

Cash: 11%

-----------------

The month of July brought me an additional 10% return to my portfolio. Praise God for this for He has provided to help me meet our family debt! Though I'm a bit disappointed because my benchmark increased by 19%. :( I was depressed for about 10 minutes, but I was relieved after I realized the MER factor in July.